Mathematics in Fashion: Unraveling the Rise of Math Shirt Trends

In the ever-evolving tapestry of fashion, a distinct pattern has emerged, weaving its way into the closets of the fashion-forward and the intellectually curious alike – the rise of Math shirt trends. These shirts, adorned with mathematical equations, formulas, and geometric patterns, defy conventional fashion norms and celebrate the beauty of mathematics in a visually striking manner. Join us as we embark on a journey through the intersection of mathematics and fashion, exploring the origins, symbolism, and the growing popularity of math shirts.

The Origins of Math Shirt Trends

The marriage of mathematics and fashion might seem like an unconventional union, but its roots delve into history. From the intricate patterns of Islamic geometric art to the iconic designs of M.C. Escher, mathematical elements have long been intertwined with artistic expression. In the realm of fashion, the emergence of math shirt trends can be traced to the desire for intellectual and visual stimulation, transcending traditional aesthetics.

Symbolism Beyond Numbers

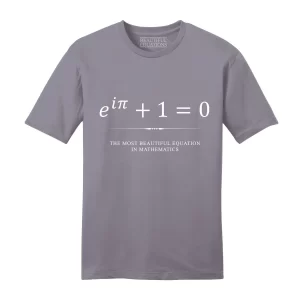

Math shirts extend beyond mere numbers and equations; they encapsulate symbolic meanings that resonate with wearers. The utilization of famous mathematical constants like π (pi) or φ (phi) serves as a subtle nod to the wearer’s affinity for precision, logic, and the inherent beauty found in mathematical concepts. The symbols become a silent language, allowing individuals to express their intellectual identity through the medium of fashion.

Geometric Elegance on Fabric Canvas

Geometric patterns, synonymous with mathematical principles, take center stage in the design landscape of math shirts. From tessellations to fractals, these patterns serve as visual representations of mathematical concepts that unfold elegantly on the canvas of fabric. The interplay of shapes and lines creates a harmonious visual spectacle that appeals to both mathematical enthusiasts and those with an appreciation for artistic symmetry.

The Rise of Intellectual Chic

In a world where fashion is often synonymous with trends and aesthetics, the ascent of math shirts introduces a new dimension – intellectual chic. These shirts become a statement piece, transcending the traditional boundaries of fashion by infusing an intellectual allure. Wearers proudly showcase their love for mathematics, transforming the equation-laden fabric into a canvas that communicates both style and substance.

Niche Appeal and Inclusivity

Math shirts, with their niche appeal, have found resonance within various communities. From mathematicians and scientists to educators and students, the inclusivity of math shirts extends across diverse demographics. The shirts foster a sense of community among individuals who share a common passion for mathematics, creating a visual bond that transcends professional or academic boundaries.

Educational Empowerment Through Fashion

Beyond their aesthetic appeal, math shirts play a subtle yet powerful role in educational empowerment. By featuring mathematical concepts in a visually engaging manner, these shirts become conversation starters, sparking curiosity and interest in the world of math. Wearers, unintentionally, become ambassadors of mathematical literacy, breaking down stereotypes and fostering a positive perception of the subject.

Beyond their aesthetic appeal, math shirts play a subtle yet powerful role in educational empowerment. By featuring mathematical concepts in a visually engaging manner, these shirts become conversation starters, sparking curiosity and interest in the world of math. Wearers, unintentionally, become ambassadors of mathematical literacy, breaking down stereotypes and fostering a positive perception of the subject.

The Intersection of Art and Science

Math shirts exemplify the seamless intersection of art and science. Designers, often possessing a background in mathematics or a deep appreciation for its elegance, navigate the realms of creativity to craft shirts that bridge the gap between disciplines. The result is a wearable masterpiece that harmonizes the abstract beauty of mathematics with the tangible canvas of fashion.

The Future of Math Shirt Trends

As math shirt trends continue to gain momentum, the future promises an even more diverse and innovative landscape. Designers, fueled by a passion for both mathematics and fashion, will likely explore new realms of creativity, introducing fresh perspectives and pushing the boundaries of mathematical expression in fashion. The growing acceptance of intellectual chic suggests that math shirts will not merely be a fleeting trend but a lasting genre that finds its place in the ever-evolving narrative of fashion.

At the heart of funny science shirts lies the alchemy of puns. Puns operate on the principle of double entendre, where a word or phrase is employed to evoke multiple meanings or humorous wordplay. In the universe of science, puns seamlessly integrate complex concepts with everyday language, creating a delightful fusion of wit and wisdom. These linguistic acrobatics activate the brain’s reward centers, providing a surge of pleasure when the audience decodes the clever play on words.

At the heart of funny science shirts lies the alchemy of puns. Puns operate on the principle of double entendre, where a word or phrase is employed to evoke multiple meanings or humorous wordplay. In the universe of science, puns seamlessly integrate complex concepts with everyday language, creating a delightful fusion of wit and wisdom. These linguistic acrobatics activate the brain’s reward centers, providing a surge of pleasure when the audience decodes the clever play on words. Scientifically speaking, laughter triggers the release of dopamine, the brain’s feel-good neurotransmitter. The intricate dance of linguistic wit, visual delight, and shared knowledge in funny science shirts choreographs a symphony of humor that resonates with the brain’s reward system. As wearers and admirers engage in laughter, they immerse themselves in a cascade of neurochemical joy, reinforcing the positive association with the shirt and its comedic elements.

Scientifically speaking, laughter triggers the release of dopamine, the brain’s feel-good neurotransmitter. The intricate dance of linguistic wit, visual delight, and shared knowledge in funny science shirts choreographs a symphony of humor that resonates with the brain’s reward system. As wearers and admirers engage in laughter, they immerse themselves in a cascade of neurochemical joy, reinforcing the positive association with the shirt and its comedic elements.

Geek Chic isn’t limited to casual settings. Take your geek-inspired style to the office by incorporating subtle elements into your corporate wardrobe. Pair a geek-themed button-down shirt under a tailored blazer or cardigan for a professional yet playful look. The key is to find the right balance – subtle enough for the office, yet bold enough to showcase your personality.

Geek Chic isn’t limited to casual settings. Take your geek-inspired style to the office by incorporating subtle elements into your corporate wardrobe. Pair a geek-themed button-down shirt under a tailored blazer or cardigan for a professional yet playful look. The key is to find the right balance – subtle enough for the office, yet bold enough to showcase your personality.